Overtime pay calculator after taxes

An employee whose regular pay rate is 18 an hour worked 43 hours last week but work time was added to the payroll as 40 hours. For example if an employer says Ill pay you 12000 a year on a bi-weekly payment cycle with a 2000 end-of-year bonus the employer has agreed to pay a base pay of 120000 a gross.

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Your annual salary remains the same whether it is a leap year or not.

. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Exceptions including premium pay for overtime shift differentials or work on holidays are on a two-week lag. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status.

2011 51 Cal4th 1191 1206 The California Labor Code does apply to overtime work performed in California for a California-based employer by out-of-state plaintiffs in the circumstances of this case such that overtime pay is required for work in excess of eight hours per day or in excess of 40 hours per week. The paycheck calculator is designed to estimate an employees net pay after adding or deducting things like bonuses overtime and taxes. This means higher mortgage payments once interest rates increase.

After the initial teaser period the rate changes annually. FLSA non-exempt employees that are covered must receive overtime pay for hours worked over 40 in a workweek at a rate not less than one and a half times their regular rate of pay. Your bi-weekly gross changes slightly in the first pay period of a leap year and in the first pay period after the end of a leap year due to the one day difference.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of North Carolina Taxes. If you are paid on an hourly or per diem basis your pay reflects days worked up to and including two Saturdays before pay day constituting a two-week lag.

The additional three hours of retro pay not only need to be paid but paid at 15 times the regular pay rate as they are calculated as overtime in the prior pay period. In leap years the calculation of your bi-weekly gross is based on 366 days instead of regular 365 days. Due to the lag you will receive pay two or three weeks after you stop working.

This can make filing state taxes in the state relatively simple as even if your. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years.

ARMs usually come in 31 ARM 51 ARM or 101 ARM. Please keep in mind that this calculator is not a one-size-fits-all solution.

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Bookkeeping Templates Payroll Payroll Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Salary Slip Templates 20 Ms Word Excel Formats Samples Forms Payroll Template Invoice Template Word Money Template

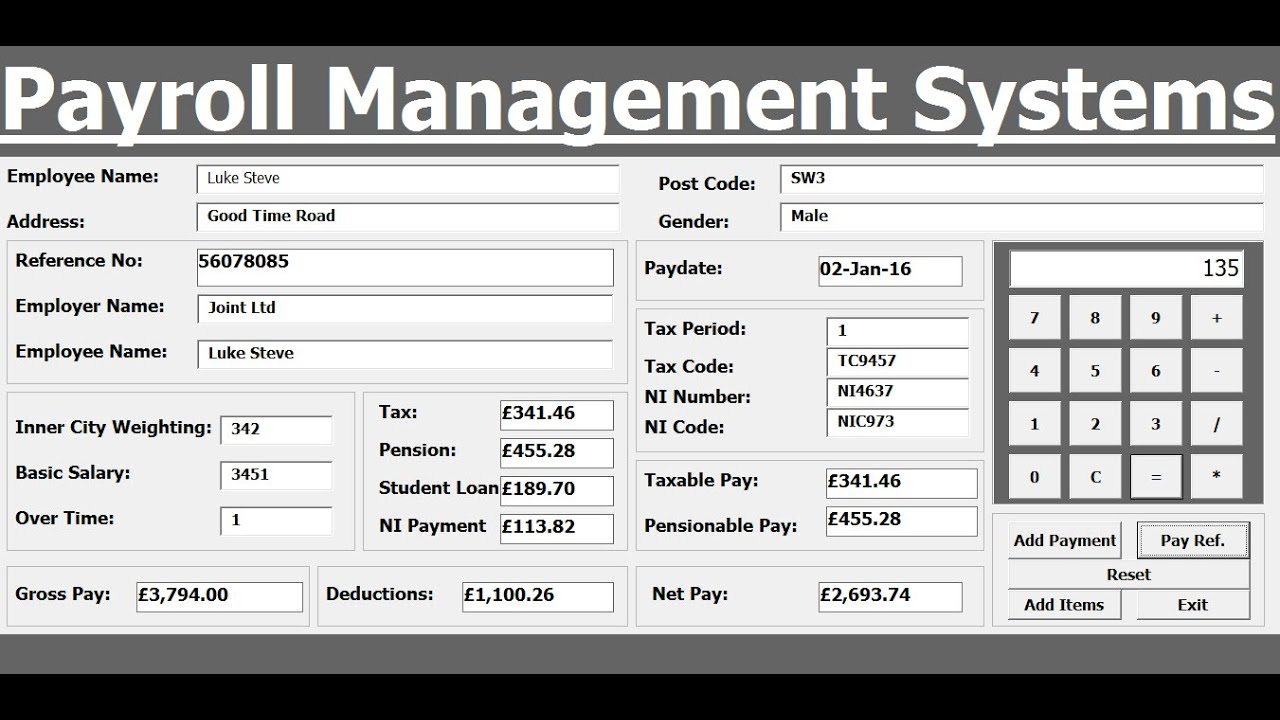

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Accounting Worksheet Template Double Entry Bookkeeping Bookkeeping Templates Worksheet Template Spreadsheet Template

Salary Increase Template Excel Compensation Metrics Calculations Salary Increase Business Budget Template Excel Budget Template

Award Winning Cloud Based Hr Payroll Software In Singapore Video Payroll Software Hospitality Design Hrms

Pin On Ideas